Why You Should Not Put Your Spend On Airline Credit Cards

Why Flexible Bank Points Are Better Than Airline Credit Cards

When you get an airline-branded credit card, you’re essentially telling the bank:

“Only earn me miles with this one airline.”

That’s fine — until you want more flexibility.

With airline cards like Delta Amex or United co-branded cards, every dollar you spend earns miles only for that airline. Swipe for gas, groceries, restaurants — Boingo — and you’re trapped earning Delta SkyMiles, United miles, etc.

That’s fine if you only ever fly that one airline — but most of us don’t. And that’s when the true weaknesses of airline-only cards become painfully obvious:

✔ You can’t easily book flights on other airlines even if prices are cheaper.

✔ Award pricing on airline charts can be extremely high (especially business class).

✔ One airline’s miles lose value over time due to program changes.

In contrast, flexible bank points from cards like Amex Business Platinum, Chase Sapphire Reserve for Business, and Chase Ink products give you the freedom to choose. They let you transfer to many airline loyalty programs where real value lives.

Real Award Pricing: Flexible Points vs Airline Clips

Here’s where the difference becomes obvious — real award prices across multiple airlines:

✈ Business Class To Europe

∆ Airline Miles (single-program cards):

- Delta SkyMiles often charges upwards of ~75,000+ miles one-way for Delta One business class to Europe (though it can vary widely by date and route). Reddit

That means if you’ve only earned Delta miles through a Delta credit card, your only good business class award option might cost a ton of miles.

✔ Flexible Bank Points (transfer options):

Because bank points transfer to many partners, you get way more choices — and often lower award prices:

💠 Virgin Atlantic Flying Club — business class one-way to Europe starts around ~29,000–48,500 points on selected routes.

💠 Air Canada Aeroplan — business class from North America to Europe ~60,000 points.

💠 Avianca LifeMiles — business class to Europe as low as ~55,000–63,000 miles.

💠 Flying Blue (Air France / KLM) — business class awards from ~60,000 one-way when available.

✔ When you transfer Chase or Amex points you can pick whichever partner has space and the lowest price — you’re not stuck earning miles for just one airline.

That flexibility can mean dozens — even hundreds of thousands — of points saved, especially in business or first class.

Why That Flexibility Matters More Than You Think

Instead of praying that your airline has saver award space, with flexible points you can:

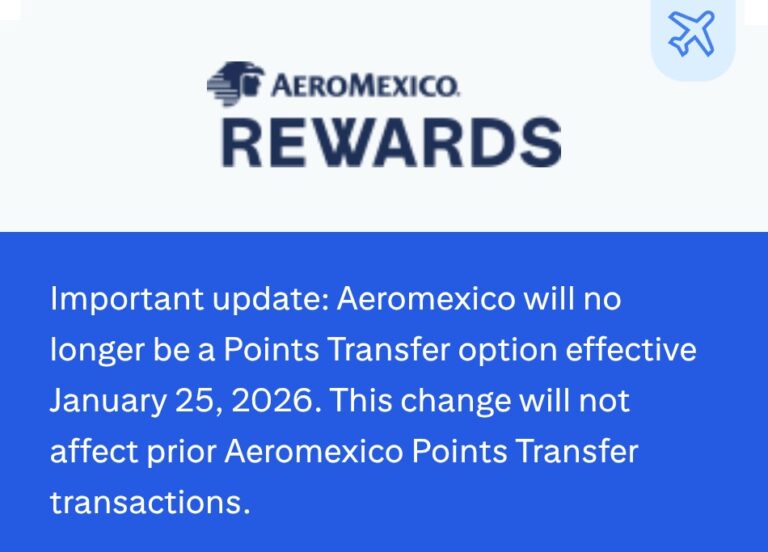

🌍 Transfer to Aeroplan, Flying Blue, ANA, Avianca, Virgin Atlantic, Singapore, Etihad, etc. — all from one bucket of points.

✈ Choose whichever partner has the lowest mileage requirement.

💺 Book more premium travel for fewer points.

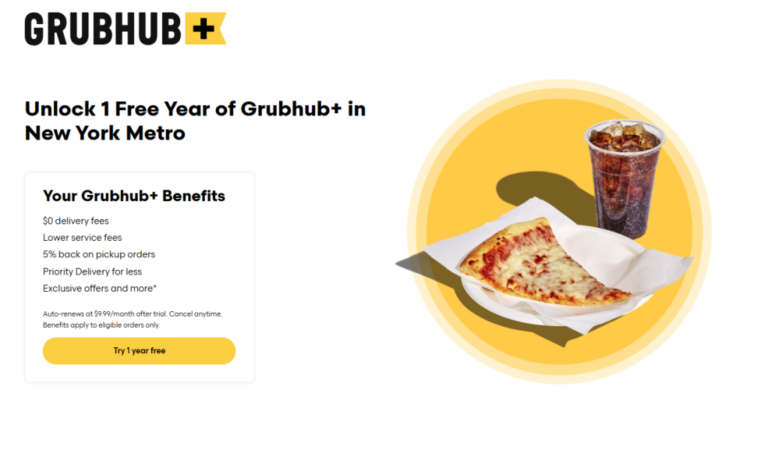

🏨 Even use points for hotels or statement credits when needed.

That’s something single-airline cards can never offer.

Best Business Cards to Earn Flexible Points

Here are the top cards to earn flexible points fast — perfect for maximizing award value:

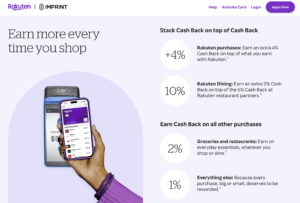

⭐ The Business Platinum Card® from American Express

💼 Earns Membership Rewards® points that transfer to ~18+ airline partners, including Aeroplan, Flying Blue, ANA, Virgin Atlantic, and more.

🌎 Best for: Frequent travelers who want access to high-value transfer partners.

👉 Apply For Amex Business Platinum here

⭐ Chase Sapphire Reserve® for Business

💼 Earns Chase Ultimate Rewards® points, which transfer 1:1 to partners like United, British Airways (Avios), Flying Blue, and Singapore. NerdWallet

🌍 Best for: People who want a wide range of premium partner options plus travel protections.

👉 Apply For Chase Sapphire Reserve for Business here

💼 Chase Ink Business Cards

These cards earn Ultimate Rewards points that you can later combine with a Sapphire Reserve for Business (or Preferred) to unlock transfers.

👉 Apply For Chase Ink Cards here

💪 Best for: Everyday spend that builds a powerful points balance.

Bottom Line

Airline credit cards aren’t bad — they have perks like free checked bags or priority boarding — but if your goal is maximum travel value, they lose badly compared to bank points.

With flexible points you get:

✅ Freedom to book almost any airline

✅ Award pricing often much lower for the same flights

✅ Ability to pivot to the cheapest or most comfortable option

✅ Power to use points for hotels or transfer bonuses

That’s why bank points from Chase and Amex are the foundation of smart travel credit card strategies — especially for business owners and frequent travelers.

![[Targeted] Citi ThankYou Mastercard (formerly Shop Your Way) Spending Offers For 2026](https://pointsandmilesexplorer.com/wp-content/uploads/2025/05/shop-your-way_247x156-e1750187921292.webp)